“I’ve done the customer interviews… now what?” Applying it to your startup’s marketing.

As a startup founder, chances are you’ve had a million and one frameworks sent to you from well-intentioned advisors, helping you to validate, market and grow your startup.

Jobs to be done, competitor research, strategic positioning, asking unbiased questions - these are all great examples that will help you unlock how potential customers subscribe to a product like yours.

But let’s face it, they can be overly complicated. And, because there are many frameworks available and because there’s a lot of data to contend with, customer research isn’t always considered the exciting part of startup marketing.

So much so, that anything labelled ‘customer development’ is seen as a chore, and the half-completed results of your research find themselves banished to the depths of a Google doc drive.

Areas like ‘growth’ and ‘traction’ win the popularity contests. But the thing is, both need customer research to create the foundations of an early-stage startup.

Before you consider parting with your hard-earned cash (or cash injection from a nice investor) and signing up a growth marketer ask yourself the following questions:

Are you able to really tell a consultant who to target?

Which channel are you meant to focus on to get sign-ups and reduce the risk of wasting a load of cash?

How do you know which is the best segment to focus on this quarter?

Do you know what’ll get you closer to these answers?

Yep, customer research.

Handing your marketing over to someone when you’ve not carried out the basics means wasted time and wasted resources. Let’s face it, how many startups have either in abundance?

A lil note, just in case it’s not obvious. This article is based on customer research, not audience research. The assumption being that you’ve already got some paying customers. Let Rand Fishkin tell ya more:

So, let’s save you some money and get you closer to your customer, and make you feel more confident when talking to your advisors.

This post was originally featured on TechCrunch but I’ve chosen to add a heap more detail.

You need customer research to help fuel your go-to-market strategy.

Before even thinking about putting that advert out calling out for a growth marketer, I want to help you to get to grips with your customer and what is going on in their life that triggered them to use you.

Let’s put it another way:

What happened for your customer to decide ON THAT DAY your product was the one?

Why would a customer subscribe to your product?

Who else are you competing against?

If you can’t answer 100% of the questions then, my friend, please read on.

3 customer research frameworks and how to apply them to your marketing

1: Understanding why a customer really subscribed to your product (jobs to be done).

In a nutshell:

People buy products to make progress, and they certainly don’t buy products randomly.

Framework/theory:

The Jobs to Be Done theory, (Moesta and Christensen versions).

You may have heard a marketer speaking on your accelerator refer to Jobs to Be Done (JTBD). This is something that helps you to understand what your customer is looking to achieve when ‘hiring’ your product.

A basic example to demonstrate this is the story of purchasing a hammer. You don’t hire a hammer to hit the nail in the wall, you ‘hire’ a hammer to hang a picture to make your room look nice because you’re planning on selling it.

It’s bigger picture stuff. The same goes with a tech product. You need to work out what your product can help your customer achieve.

The process:

You want to interview the right customers and ask questions such as, ‘what were you ultimately trying to achieve? ‘What’s the first thing you did when…?’ or ‘have you tried to fix this problem yourself, and if so, which products have you pulled together?’

The emphasis needs to be on what they are trying to accomplish. Take note, this can be a lengthy process because you have to really dig into interviews, but the rewards are totally worth it.

How you could apply it to your startup’s marketing:

You may be facing a shortage of leads or perhaps you want to explore a free trial for your product. If this is the case, there’s a chance that you already have customers - you’re now trying to find a new way to stimulate growth.

From conducting Jobs to be Done, you may find yourself faced with a few segments of customers with different ‘jobs’. That’s okay. The idea behind this framework is to help you identify the group that will pay the most to get the ‘job’ done the best.

This may help to speed up the sales cycle or identify more lucrative customer opportunities. If ya feeling all nerdy about this, check out my case study on how I applied jobs to be done to marketing for The Re-Wired Group.

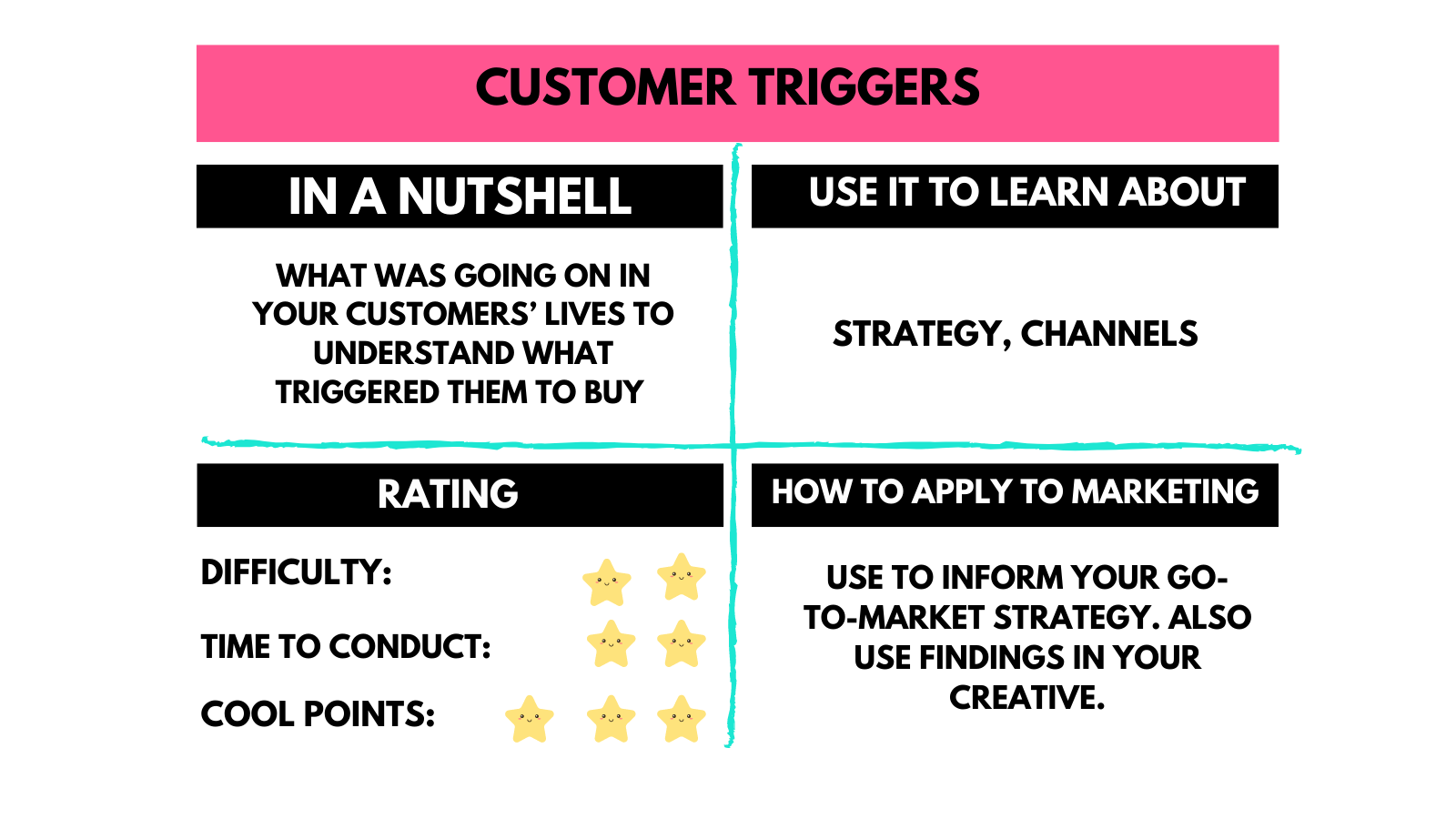

2. What triggered your customer to decide your product was the one?

In a nutshell:

Dig into what was going on in your customers’ lives to understand what triggered them to hit ‘subscribe!’

Framework/theory:

The 6 stages of making a purchase (Customer Camp and Demand-Side Sales)

There are many frameworks to help you navigate this customer research piece, and, in my opinion, the effective ones are broadly based on the work of Moesta. He suggests there are six stages a customer will go through when buying something: first thought, passive looking, active looking, deciding, onboarding and ongoing use. It’s something I’ve delved into…

The process:

Your customers don’t really care about you and your brand. Sorry, not sorry.

In fact, when they first started exploring a potential solution, you may probably didn’t even come up on the list.

So the aim of this approach is to talk with your customers to learn what they did and where they went to research alternatives during the purchase process that led them to you.

People don’t buy things randomly, there are a number of forces at play that will move you further along the buying process. Your aim is to interview customers documentary-style to learn what process, website, influencer and motivation kicked in and where.

How you could apply it to your startup’s marketing:

Once you’ve learned your customers’ trigger points - i.e. those subtle or not-so-subtle nudges that forced them along that buying cycle, you’re in a better position to understand where to place your brand, content and product.

In essence, you’re building the blocks of your startup’s go-to-market strategy. You want to understand how your customer looks for and buys a product like yours, and make sure you’re there at the right time.

These interviews will give you an idea of what emotions, motivations and feelings a customer had. This is all useful information that can also help you with the creative in your advertising.

You can also use this to explore whether a sales-led or product-led strategy is best to pursue. Asking about the details of the sign-up process, and the questions they may have, and the complexities they need are details to consider.

3. Who else is your product competing against?

In a nutshell:

Whether you like it or not, you have competitors. This process helps you to connect the ‘job’ your customer wants to achieve and who’s in the running for their business.

Framework/theory:

There are three types of competitors: direct, indirect and replacements. A direct competitor is a business that offers the same/similar product in the same category as the one you operate in. An indirect competitor is a business that offers the same/similar product but in a different category. The replacement competitor is a business that sells a different product, but it still (kind of) gets the job done.

The process:

No, don’t tell me that you’ve got no competitors.

Nope. Lies! Liza Minnelli lies!

Whether you like it or not, you’re going to compete against other products or solutions. It doesn’t matter if you believe your product is superior, something else or someone else is taking money or business from you.

I want you to collect information about who else is competing with your product when you’re conducting your interviews or collating your results from surveys on your website.

List the direct and indirect competitors you may have. To best understand who may be a replacement competitor, you need to understand what your customers’ jobs to be done is.

Let’s use Asana as an example. A direct competitor would be Basecamp, an indirect competitor maybe AirTable and a few Zapier Zaps. A replacement competitor may be getting a project manager in.

How you could apply it to your startup’s marketing:

If your customer acquisition efforts have slowed way, you could use this to look at what your competitors are doing. It’ll give you an indication of the way potential customers buy.

I personally believe it has real value in the positioning of your product. Once you learn who you are really competing against, and for which customer segment, you’ve got the chance to work on your positioning.

What's the one thing you do really well? How will you use this against your competitors? This informs everything from strategy to the words on your website, to the marketing activity you choose to get involved in (and not get involved in!)

Summary

These are just a few ways to understand your customers or potential customers more.

So, day to day, I work with founders by offering a series of SaaS startup marketing products.

The other day, I spoke to someone who said that their customer was ‘Gen Z’. After asking a little more about the customer, I realised that they couldn’t give me any more information. But they wanted to skip the strategy part, and straight to the tactics (running Facebook Ads). Based on what you’ve read so far… do you think they’d be able to do an effective job by skipping the research?

If you market to everyone, you market to no one.